Think Outside the Bank For Private Lending

At Level 4 Funding, you get flexibility and speed, not red tape and committees. Bottom line: if your strategy is sound and your property has potential, we’ll find a way to make your loan work—without the drama and without the runaround.

And you can take that to bank.

Our specialty is helping, realtors, and investors purchase or refinance non-owner occupied residential properties. So if you’re looking for a respected lender that offers streamlined services, quick closings, and aggressive rates, you’re in the right place.

Non-conforming mortgage products for Non-Owner Occupied Residential properties

When traditional loan products are not flexible enough to meet your client’s needs, Level 4 Funding can help. We provide investors with quick access to non-conforming mortgage products for Non-Owner Occupied Residential properties whether they want to:

Fix & Flip

Buy & Hold

Rate & Term

Cash Out Refinance

Bridge Financing

Wholesale Lending

Real Estate Agents

You work to help your clients reach their real estate investment goals and so do we. Fast Approvals. Competitive Rates. Quick Closings. How can we do that? Level 4 Funding is a direct private hard money lender with local control from start to finish. We underwrite our own files and provide our own appraisals which makes our loan process transparent and fast, closing deals in as little as 4-10 days.

Imagine Having $50K-$250K Cash In Your Checking Account For Anything Your Business Needs F4F.com www.civicfs.com fundingforflipping.com

Flipper Program

Loan Amounts: $50,000 - $3 million

Loan to Value (LTV): up to 90% of the purchase price, plus 100% of the construction funds.

Interest Rates: 8% to 18%*

Points: 1-4 points

Loan Position: 1st TD

Loan Term: 6 or 60 Months

Property Types: Residential, Condos, 2-4 Plex, PUDs

Loan Types: Non-owner occupied residental. Purchase, Refinance, Bridge Loan, Rehab, Business Loans

Commercial Program

Loan Amounts: $250,000 - $25 million

Loan to Value (LTV): up to 60% Loan Type: Acquisition, Refinance, and Cash-Out

Interest Rates: 7.9% to 14%*

Fees: 1 - 3 points

Loan Term: 3 - 260 months.

Property Types: Residential, Condos, 2-4 Plex, PUDs

Loan Types: Non-owner occupied residential, multifamily, retail, office, industrial, mixed use, vacant buildings, and entitled land

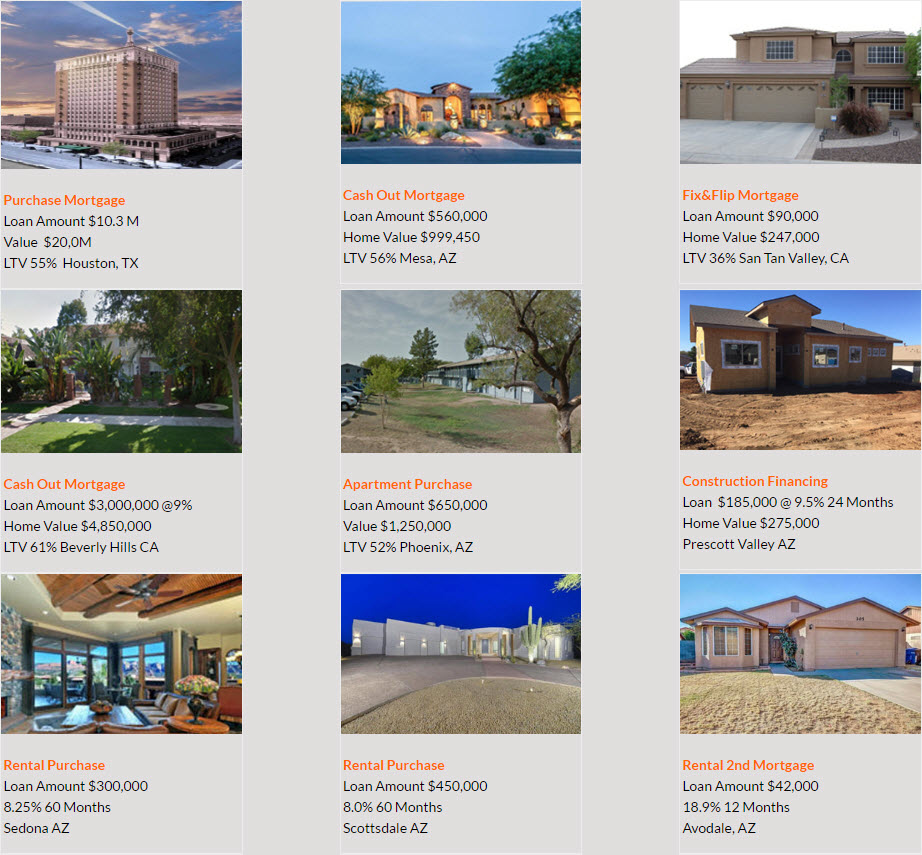

Just Funded Private Hard Money Loans