Real Estate Bridging Loans

Ideal loan product for homeowners who are moving from their current home to a new home.

Bridge Loans - 3 to 12 months

From 7.5% APR*

How it works:

Bridge Loans are short term 3-12 month loans that allow you to Bridge from one Asset to the Next.

It allows you to keep and use your current asset while purchasing the next Asset. You can move in to your next home before you sell your current home.

For a real estate you can use a bridge loan to finance the initial construction of a dwelling with a terms of twelve months or less, such as a loan to purchase a new home where the consumer plans to sell a current dwelling within twelve months.

Reasons to take a Bridge Loan:

• Move before you sell your current home

• A better alternative than obtaining an equity partner

• Bridge the gap, while waiting on conventional financing

• Down payment to begin a build-out project

• Acts as a line of credit with access to 5 loan drafts over 120 days

• Equipment purchasing

• Cash flow stabilization

• Working capital

• Acquisition

• Turnaround financing

• Capital expenditures

• Debtor-in-possession (DIP) financing

• Growth

• Recapitalization

• Refinancing/restructuring

• Buyout

• Leveraged employee stock ownership plan (ESOP)

Benefits of Bridge Loan:

- Can buy without worrying if you can sell your house

• Sell your home when you are out of the old and its vacant

• Buy a new home and move now

• Allows you to move before you sell your house.

Just complete the Get Started and we can give you a quick no obligation quote.

Rate and Terms

UP TO 90% LTV

3-24 Months, Interest Only

From 7.5%*

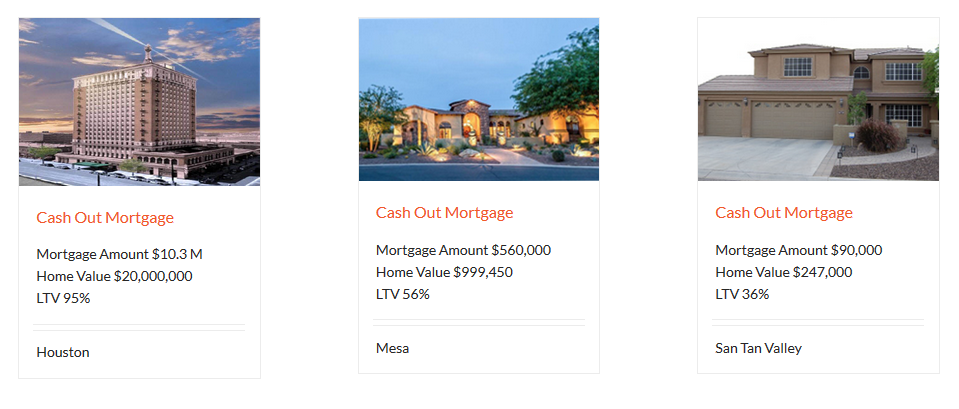

Prior Funded Homes by Level 4 Funding

Equal Housing Opportunity.

*APR varies from 7.5 – 29%. Your loan rate and how you can borrower is primarily determined by the quality and value of the collateral, your ability to pay, total loan to value and credit score.

This is not a Good Faith Estimate (GFE) and should not be considered as such. Costs, rates and terms can only be determined after completion of a full application. Mortgage rates could change daily. Actual payments will vary based on your individual situation and current rates. To get more accurate and personalized results, please call (623) 582-4444 to talk to one of our licensed mortgage experts. Terms and conditions of this and all loan programs are subject to change without notice. Level 4 Funding LLC is licensed in the State of Arizona, NMLS 1018071 AZMB 0923961.