Wild West Phoenix Real Estate is Heading for a New Boom Time–Yeahaw Getty UP

Wild West Phoenix Real Estate is Heading for a New Boom Time–Yeahaw Getty UP

February 11, 2013Arizona Real Estate Specialist Predicts New Real Estate Boom on The Horizon!

February 12, 2013Wild West Phoenix Real Estate is Heading for a New Boom Time–Yeahaw Getty UP

With low inventory and too many buyers, the Phoenix Real EstateMarket is on the verge of a new boom in real estate values.

With low inventory and too many buyers the Phoenix Real Estate Market is on the verge of a new boom in real estate values.

“This boom is going to be different,” according to Sandy Dahlberg, Apple Wood Fund Hard Money Lender. “The last boom was fueled on greed of the consumer; this time it’s going to be a supply problem. Over the past 6 years there was little construction or movement of dirt, leaving the Phoenix housing market starving for new homes. Additionally, home values are raising dramatically, and once the current home owners get above water (have equity) they are going to want to move up. We’re going to have a trifecta or the perfect storm-no homes, pent-up demand, and record low interest rates. And if you throw a little inflation on top of the mix – watch out! Bam! its going to be a wild ride – a wild west ride!”

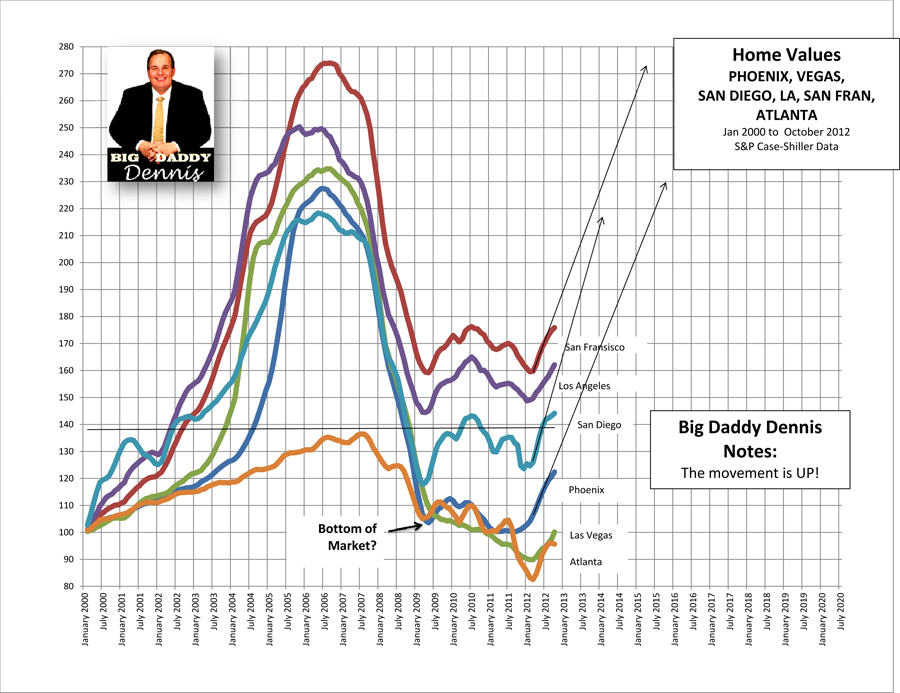

Based on the data provided by S&P Case Shuller, the bottom is over and we are moving up again and this time it’s going to be even bigger! (For a high resolution [click here Real Estate Values])

It appears from the graph of the Phoenix House Values below, that the real estate market in the Phoenix area is heading up. Is it time to buy real estate again? How long will it take to come back to normal? Should I get out of the market and wait? These are hard questions to answer but Sandy makes these recommendations:

— Home values will not return to the trend line for another 1-2 years. Latest trend shows Phoenix back to the highs starting July 2014!

— The upturn in values are due to LACK OF INVENTORY AND RECORD LOW INTEREST RATES.

— Keep your home if possible. Do whatever it takes to keep the current home.

— Do a loan modification? HAPR 2. Its possible but there are very few who are successful.

— If you ‘bail out’ and let the bank foreclose, you will not be able to purchase a home for 5-7 years, maybe even never again!

— Inflation will it come back and will the value of the dollar drop dramatically? (This could change if the USA will cut spending and raise taxes, cut medical/social security, and increase the tax rate by 45%. I don’t think this will happen.)

— The amount of debt in the USA will continue to grow. The amount is very frightening.

— At this rate,in 5-7 years, it will cost $10 to buy a loaf of bread. Gasoline will cost $25/gallon. And the average starter home price will be $600,000.

— Get out of debt; get rid of the credit cards and pay them off. Purchase only if you have the cash. Do not get into any debt. (I sound like your mother here, but she was correct.)

— Start a side business. It’s too difficult to explain why here, but the best reason is the potential tax advantage and the possible income. Your own side business is the LAST area the government has yet to attack. Make it simple and get going. An extra $400 per month really helps.

— If you are able, purchase quality single family homes in a good area and turn them into rental units. (Your side business?)

— Home values will not return to the trend line for another 1-2 years. Latest trend shows Phoenix back to the highs starting July 2014!

— The upturn in values are due to LACK OF INVENTORY AND RECORD LOW INTEREST RATES.

— Keep your home if possible. Do whatever it takes to keep the current home.

— Do a loan modification? HAPR 2. Its possible but there are very few who are successful.

— If you ‘bail out’ and let the bank foreclose, you will not be able to purchase a home for 5-7 years, maybe even never again!

— Inflation will it come back and will the value of the dollar drop dramatically? (This could change if the USA will cut spending and raise taxes, cut medical/social security, and increase the tax rate by 45%. I don’t think this will happen.)

— The amount of debt in the USA will continue to grow. The amount is very frightening.

— At this rate,in 5-7 years, it will cost $10 to buy a loaf of bread. Gasoline will cost $25/gallon. And the average starter home price will be $600,000.

— Get out of debt; get rid of the credit cards and pay them off. Purchase only if you have the cash. Do not get into any debt. (I sound like your mother here, but she was correct.)

— Start a side business. It’s too difficult to explain why here, but the best reason is the potential tax advantage and the possible income. Your own side business is the LAST area the government has yet to attack. Make it simple and get going. An extra $400 per month really helps.

— If you are able, purchase quality single family homes in a good area and turn them into rental units. (Your side business?)

I’ve talked to a lot of people who feel that they can ‘let their home go and rent for awhile’. Rental rates are lower than their mortgage rates. Yes, they are! ‘We can save a lot of money by renting vs. paying the mortgage, and in 2 years we can purchase again and have a good down payment.’ Well, it’s actually going to be 5-7 years before your credit report looks good enough to purchase a home again. And can you really save the money? Most people will spend the money on toys. If hyper-inflation hits, like some economists predict, then you’ll be priced out of the market. Do you want to take the chance? Keep your home, do a HARP 2 loan modification, and hang on – the next 5-7 years are going to be enjoyable.

Sandy Cramer is General Manager of Apple Wood Fund, with many years of flipping and fixing real estate experience.